These loans might sound like a great deal, but they have major downsides. It merely gives them the ability to opt-out during a set number of years. Zero-principal mortgages generally don’t prevent the homeowner from making payments on the principal.

These mortgages might be ideal for house flippers who know they’ll be selling the house during the initial period. With this type of mortgage, the homeowner has a smaller monthly payment in the early years, and then the payment goes up when they have to start paying on the principal. After that time, you’ll start paying on the principal. Most zero-principal loans stipulate a particular number of years, during which you only pay on the interest of your loan. But they also prevent you from building equity in your home.Įventually, though, you’ll have to pay back the money you borrowed. These interest-only mortgages come with smaller monthly payments since you’re not putting any money toward your principal. This type of mortgage, also known as a zero-principal mortgage is one where your monthly payments only cover the interest on the loan. There’s another type of mortgage that works a bit differently - An interest-only mortgage. The size of the debt you owe is increasing, but your principal remains the same. You’re on an income-based repayment plan, and for the first few years, your monthly payments are lower than the amount of interest accruing on your loan. Suppose you just graduated from law school with a sizable amount of student debt. So if you’ve paid off $50,000 of that $200,000 mortgage, your remaining principal is $150,000.įor other types of loans that may accrue interest, the principal does not include the interest that accrues on your loan, though you still have to pay it back too.

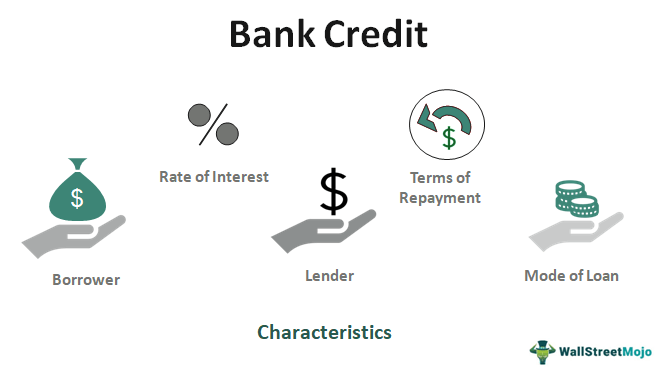

The principal could also refer to the amount you still owe of the initial amount you borrowed. Your total loan amount (your principal) is $200,000. The price of the home is $225,000, and you have a downpayment of $25,000. Let’s say you take out a mortgage to buy a house. When you take out a loan from a lending institution, the specific amount of money you borrow is the principal. Often the term principal is referring to a loan.

0 kommentar(er)

0 kommentar(er)